Neat Tips About How To Appeal Your Taxes

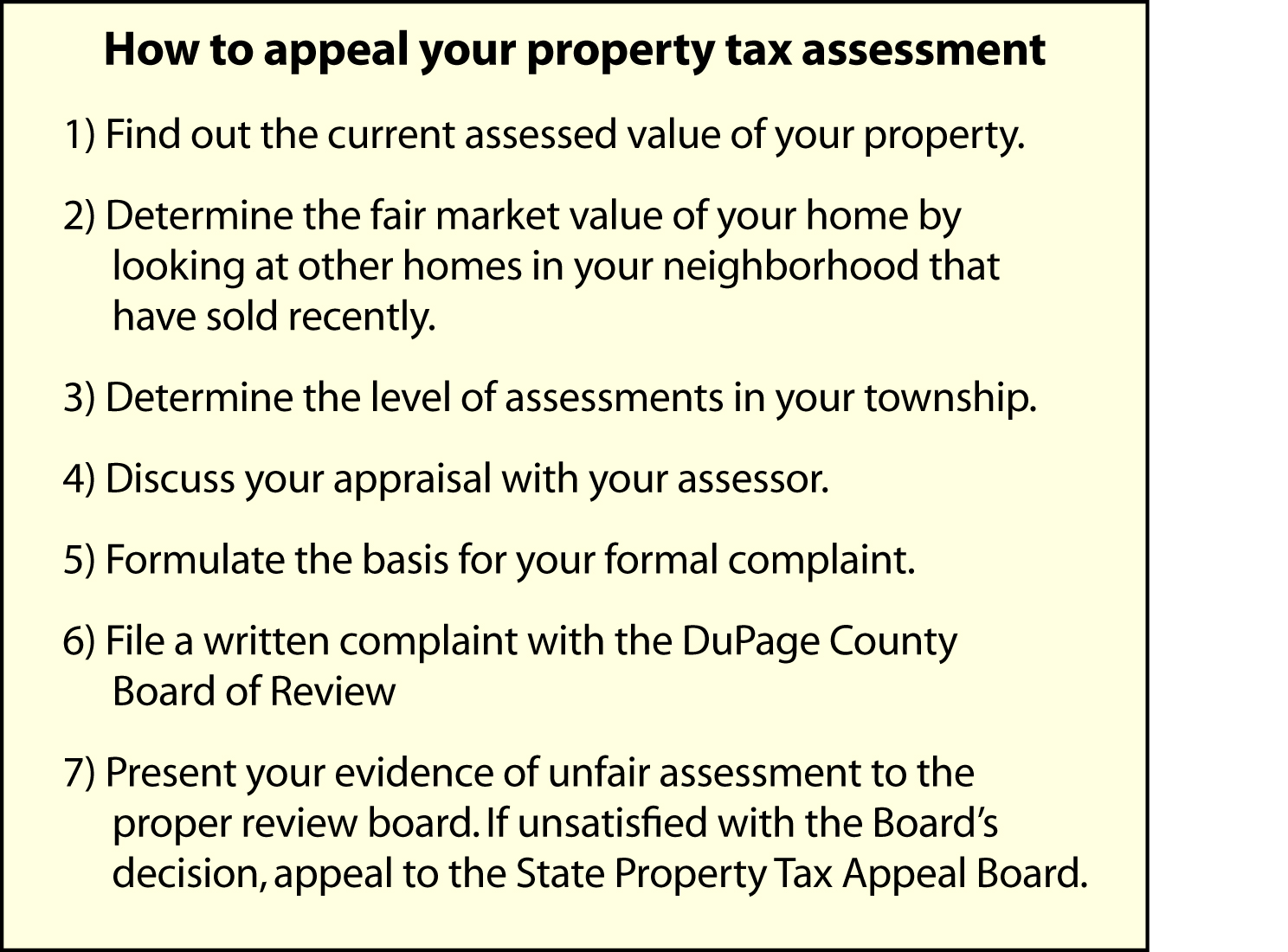

To use the worksheet, a property owner should:

How to appeal your taxes. Appeal to state property tax appeal board or circuit court. Online videos and podcasts of the appeals process. As in filing a local property tax appeal, pay close attention to the deadline dates, and make sure you file your.

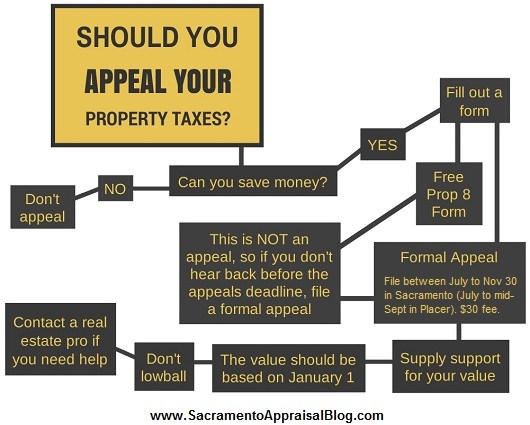

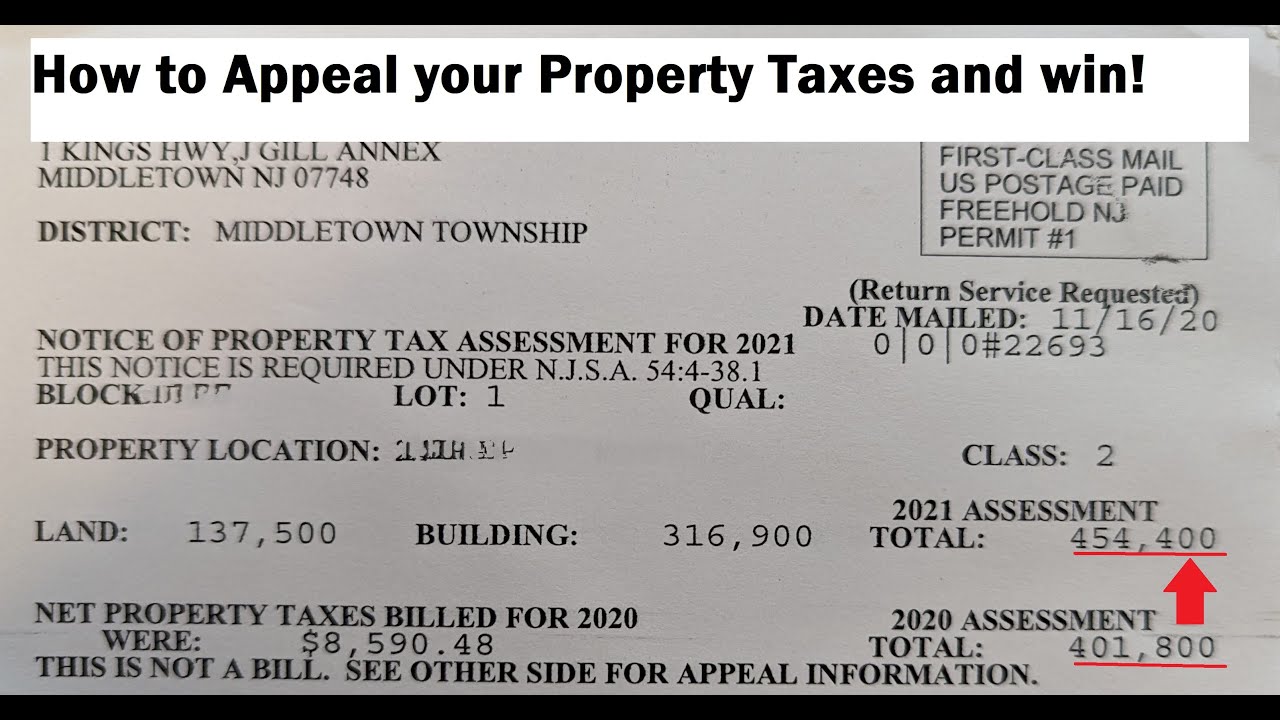

If you want to dispute your property taxes, you must file a protest by may 15 or no later than 30 days after the date on your appraisal notice. Many appraisal districts send appraised value. Check to see if your township is open for appeals.

If you file for yourself, you may check your appeal’s. You need to meet them; An appeal can only be filed during certain timeframes.

There’s absolutely nothing fun about it! If you do not agree with the county board of review's decision, you can appeal the decision (in writing) to the state property tax. This will allow you to check on the current status of your appeal at any time and allow you to instantly view appeal related documents sent to you by the board of.

To win a property tax appeal, you’ll need to prove your home has been overassessed — meaning, that it can’t sell for as much money as your assessor thinks it can. Otherwise you run the risk of losing out on the opportunity to have your appeal heard for another year. You may go on to file an appeal using the recent sales you select as support for your requested assessment reduction.

File an appeal and ask for a new assessment. If you disagree with hmrc’s decision you can make further appeals to the tax tribunal, which is an independent body that will examine evidence provided by both you and the. Provide an email address to create an account.