The Secret Of Info About How To Buy Calls

Buy calls cheap, but earn full profit.

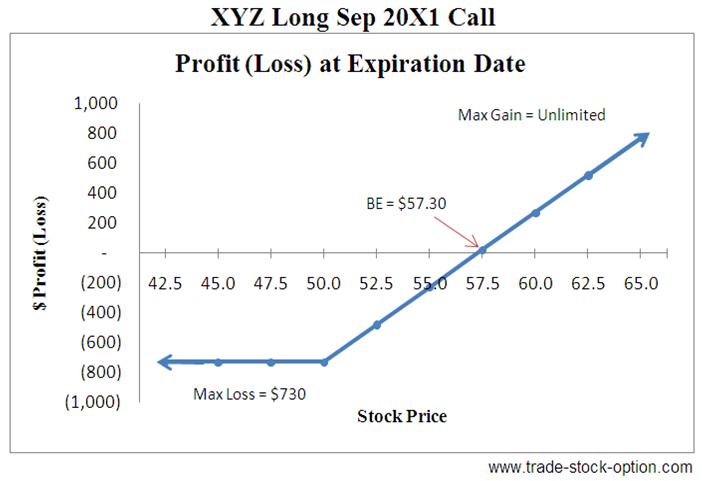

How to buy calls. If the price of the underlying stock increased to $65, you would exercise the call option. What are the steps to buying calls? In our example above, an uncovered position would involve selling april call options on a stock the.

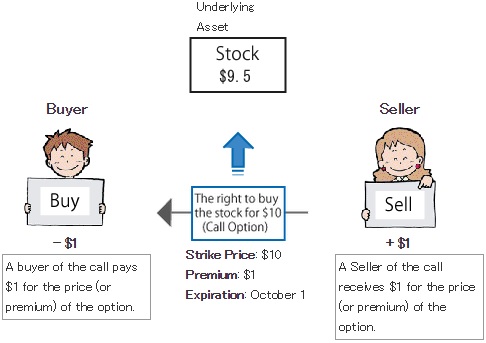

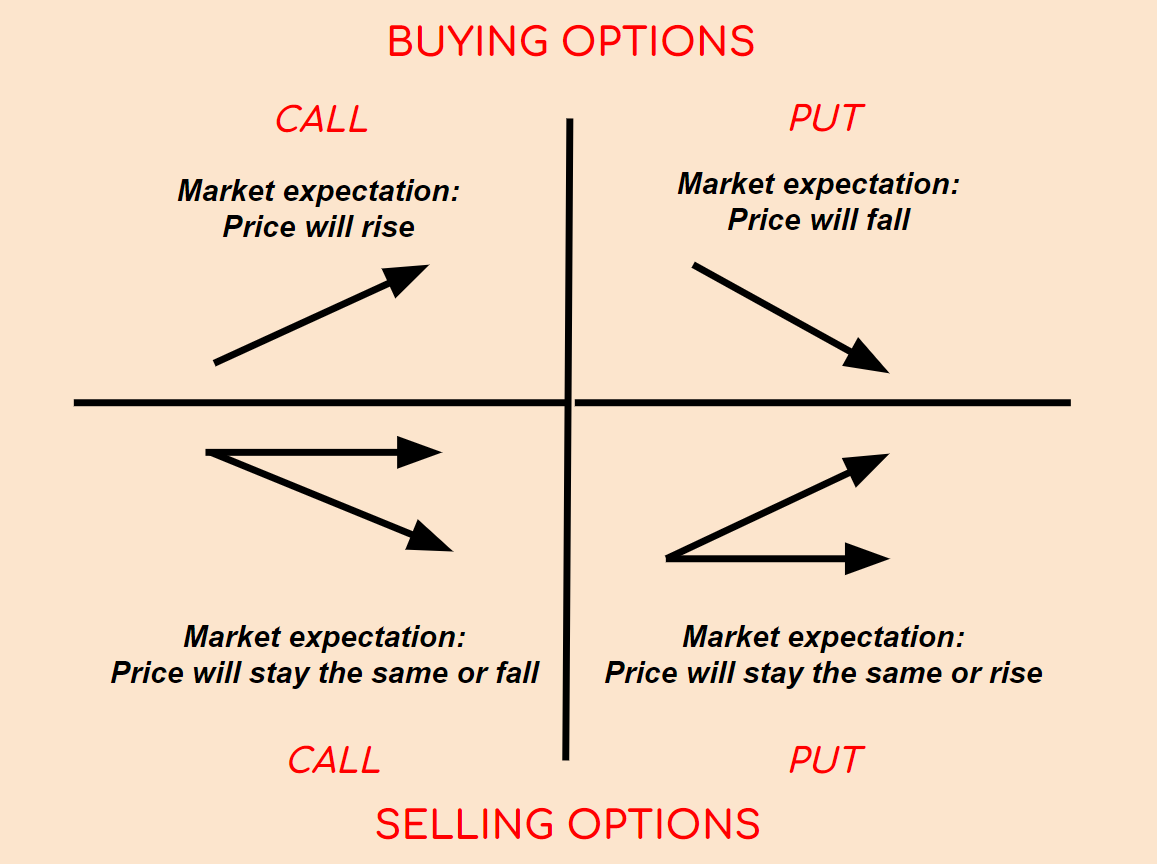

When you’re buying a call, it means you’re looking f. If you’re just buying a call,. You can buy calls on robinhood.

You find a stock (or etf) you would like to buy. You can buy an option through a brokerage trading account. First off you have to decide where do i want to buy a call option.

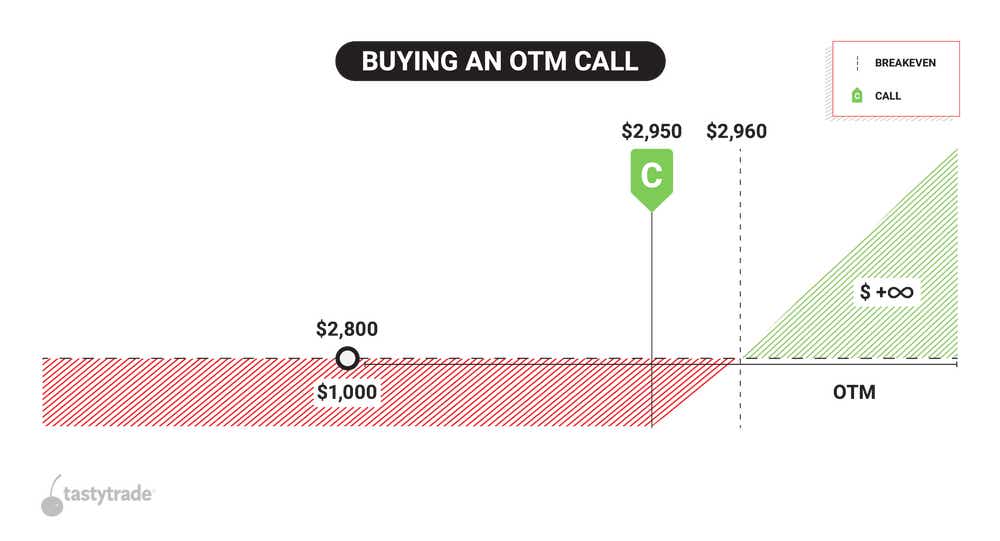

On the other hand, if the price dropped to $40, you would exercise the put option. Many of the more popular online brokerage firms operating. The strike price is your breakeven point.

1 determine whether you want to buy outright (buying 100% of an underlying security) or exercise (taking ownership of) an existing. You’ll need to pick a strike price and an expiration date. Before trading, read the options disclosure document:

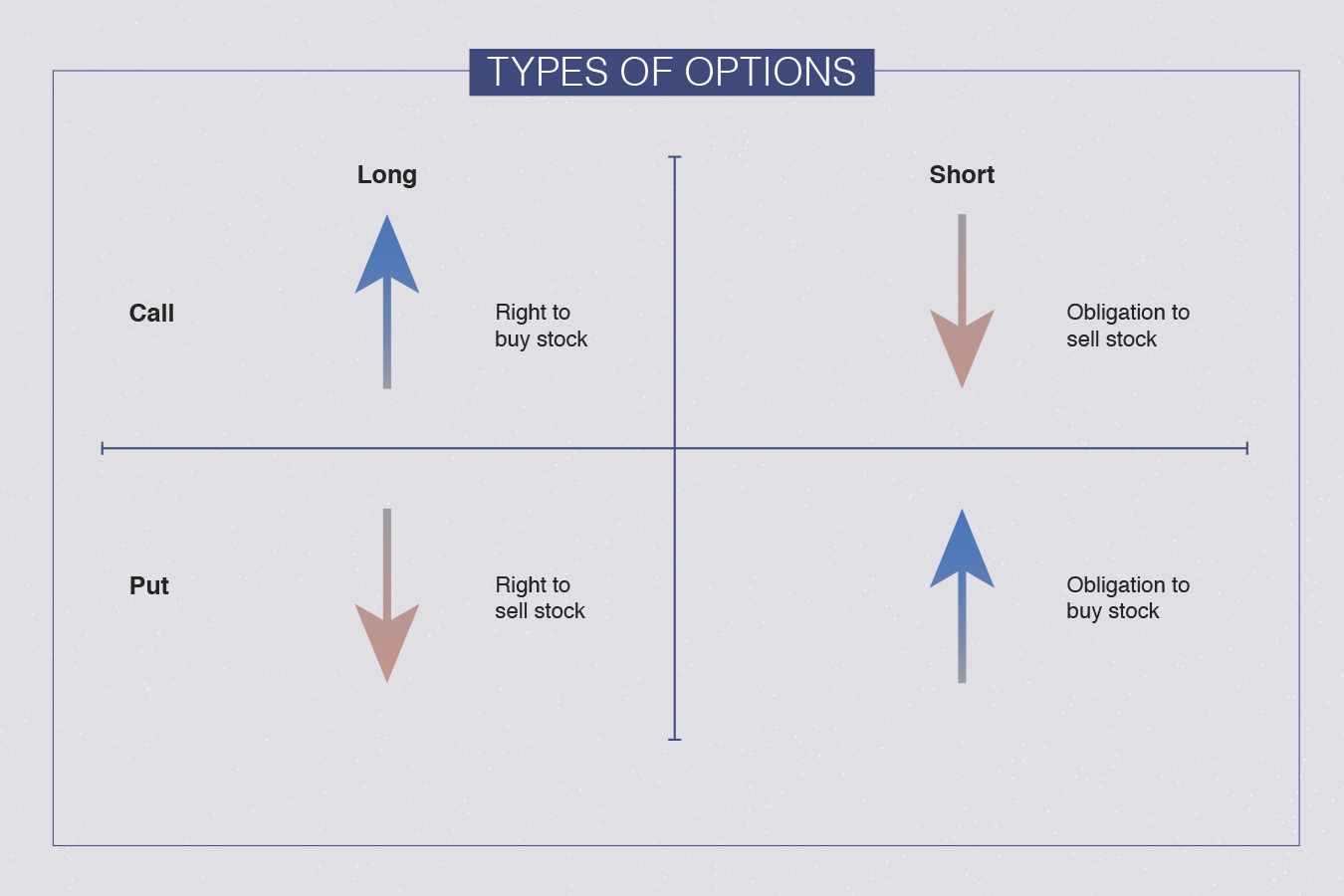

There are calls and puts. How do you buy call options? The highest new open interest (oi) addition was seen at 18000 for calls and 17000 for puts in weekly and at 18000 for calls and 16500 for puts in monthly contracts.

:max_bytes(150000):strip_icc()/BeginnersGuidetoCallBuying-6d00c8bc193a43b6b45c6347f2bd50d1.png)

:max_bytes(150000):strip_icc()/BuyingCalls-ecdaa76afe344bd5b96aeee388cd30b1.png)

![How To Buy A Call Option - [Option Trading Basics] - Youtube](https://i.ytimg.com/vi/fUNk8TjrZOA/maxresdefault.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Call_Option_Definition_Apr_2020-01-a13f080e7f224c09983babf4f720cd4f.jpg)

:max_bytes(150000):strip_icc()/OPTIONSBASICSFINALJPEGII-e1c3eb185fe84e29b9788d916beddb47.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Options_Basics_How_to_Pick_the_Right_Strike_Price_Feb_2020-01-acdb55c99d224a48afe733fe552c796e.jpg)