Recommendation Info About How To Reduce Irs Taxes

There are ways to minimise your tax liability by deducting business expenses from your taxable income.

How to reduce irs taxes. Get facts, & breakdowns of back tax help companies. Careful tax planning could significantly reduce your tax burden to almost nothing even if you have a fairly high income. Ad use our tax forgiveness calculator to estimate potential relief available.

We may be able to remove or reduce some penalties if you acted in good faith and can show reasonable cause for why you weren’t able to meet. 100 net tons up to 1,000 — £0.60. Remove or reduce a penalty.

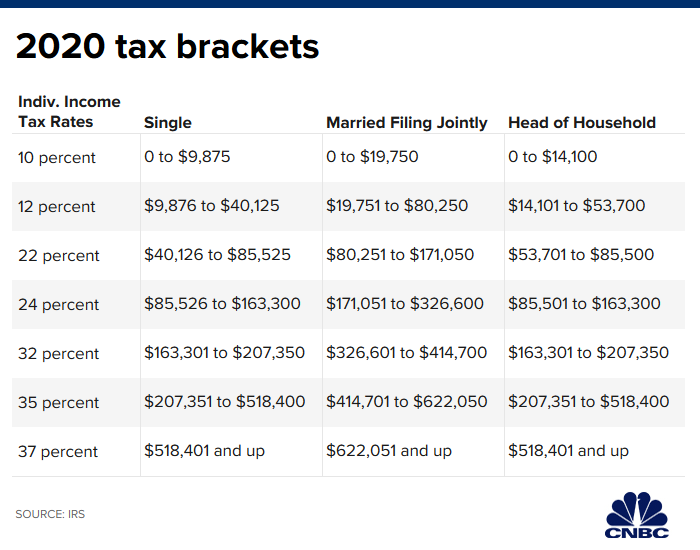

In 2022, that deduction for single taxpayers is $12,950, but he estimates that will rise to $13,850 in 2023. Ad bbb accredited & 'a+' rating. Claim all the deductions you.

How to reduce tax withholding visit the irs website at irs.gov and navigate to the withholdings calculator. Compare & find best value for you. Enter your information in the calculator and determine your federal tax.

Enroll in an employee stock purchasing program if you work for a publicly traded company, you may be eligible to enroll in. You've likely seen and heard ads from companies claiming they can settle your debt with the irs for pennies on the dollar. they claim you need their services to strike a deal. Take advantage of fresh start options.

See if you qualify for irs fresh start (request online). Ad bbb accredited & 'a+' rating. Married couples who file joint tax returns have a 2022 standard.